Essential money management

made by traders

made simple

Plan & analyze your financial portfolio way beyond spreadsheets

Plan & analyze your financial portfolio way beyond spreadsheets

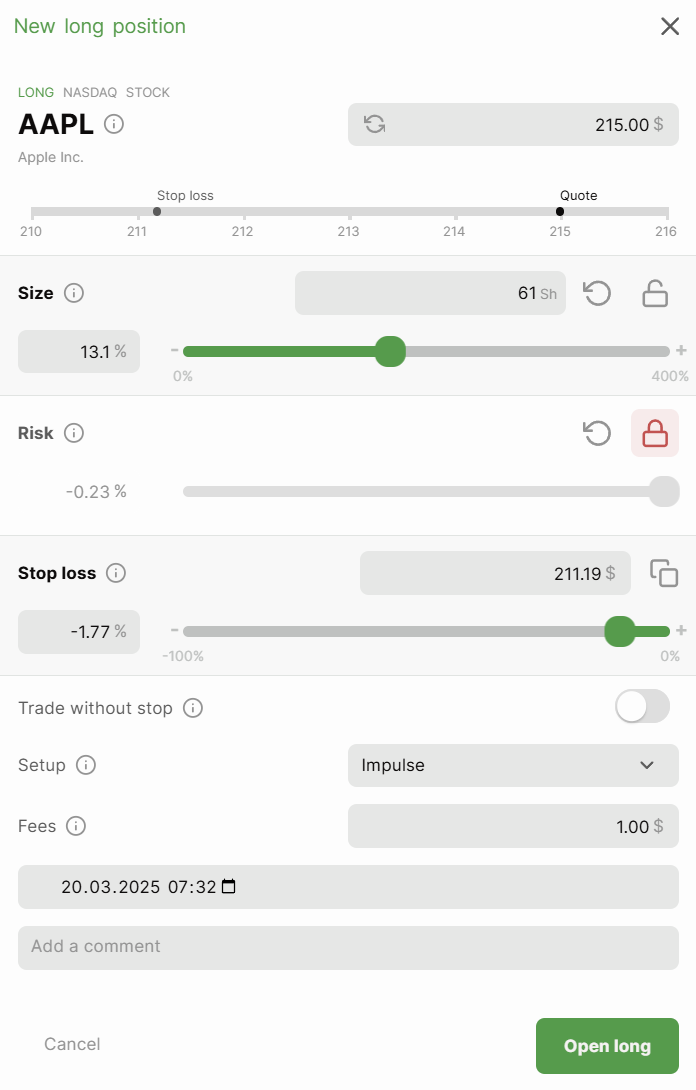

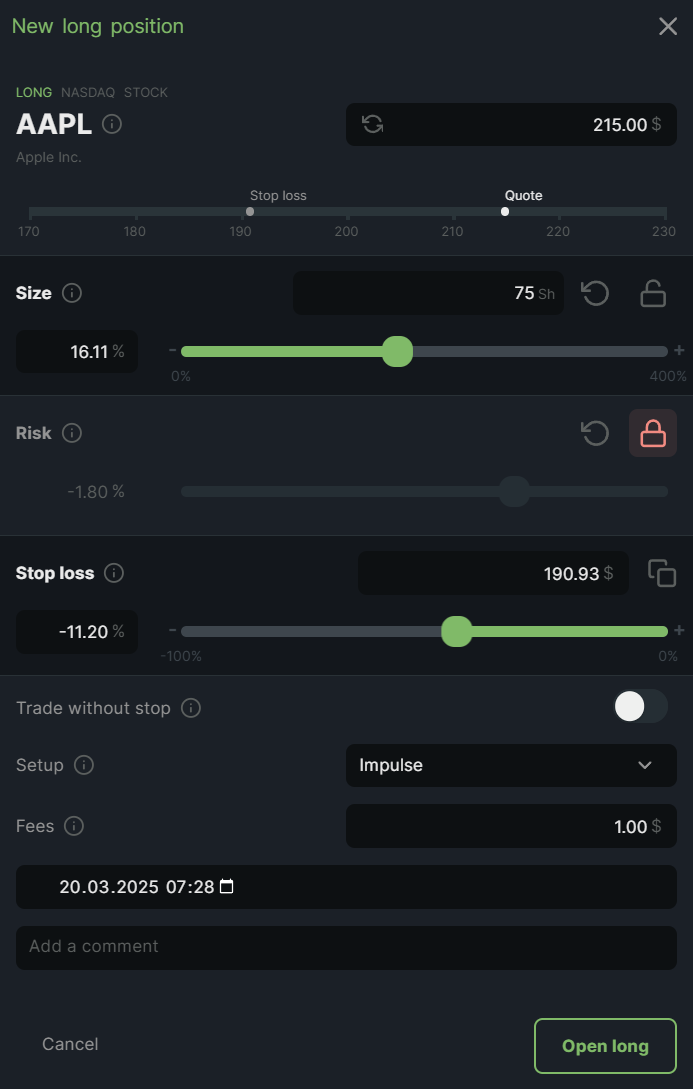

Compounding models

Choose from three flexible strategies—High (risky), Standard, or Low (conservative)—tailored to your unique trading style.

Invisible equity tracking

Tradealyze seamlessly tracks your portfolio equity behind the scenes—no broker API needed.

Pyramiding

Scale up or trim positions at will, giving you the freedom to manage your trades exactly how you want.

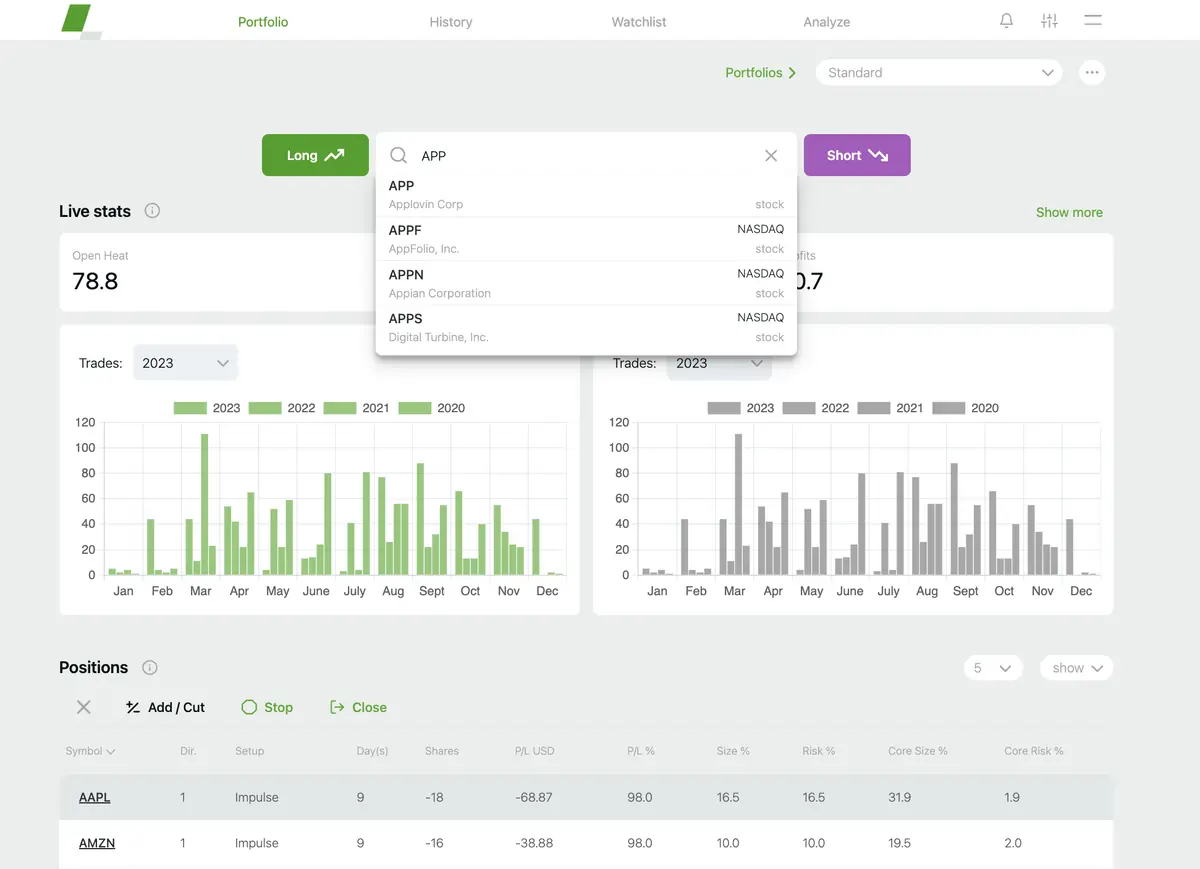

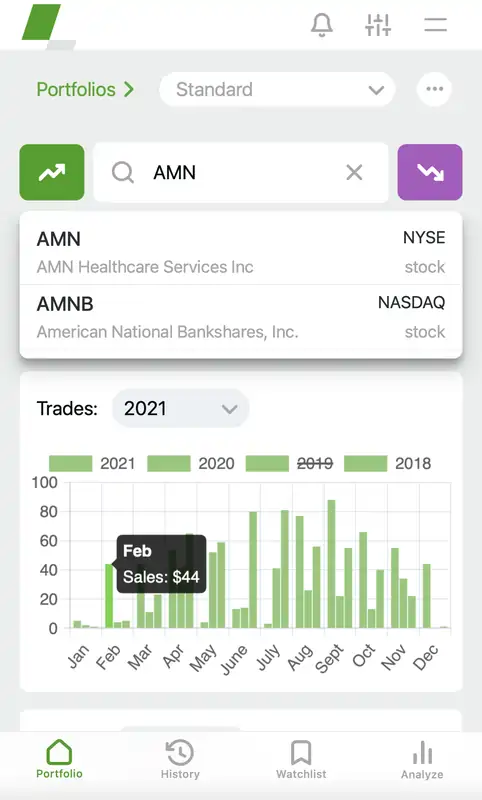

Watchlists

Plan ahead and seamlessly import watchlists from TradingView or other platforms.

Chart-first approach

Set your stop-loss or plan your entire trade directly on the chart for maximum convenience.

Basic quality filter

Filter out lower-quality stocks early on with fundamental metrics, so you can focus on better opportunities.

Real-time quotes

More than 40.000 stocks, ETFs and other instruments from around the world at your fingertips.

Base currency conversion

Manage different currencies and convert your cash manually or automatically between your base and exchange currency.

Trade journal

Comment each action, create setups and track your conviction in real-time.

Manage multiple portfolios

Manage and compare multiple portfolios and evaluate them against each other or against various benchmarks.

Mobile notifications

Receive timely alerts and notifications on your mobile phone or through other relevant channels.

Historical charts

See your entry, adds and cuts all visualized on the chart

Reward/Risk Ratio

Evaluate your Reward/Risk ratio histogram. The unique fingerprint of your trading method.

Forward expectancy calculation

Create fulfillable expectations by computing a novel and sensible expectancy calculation that is based on individual investments/trades and ignores your absolute return.

True time weighted return

Get a meaningful and comparable overview of your performance through a true time-weighted return analysis.

Win-rate and setup evaluation

The algorithm evaluates your win rate and suggests a reasonable maximum risk, position size and target reward/risk ratio based on it.

Community benchmark

Find successful setups from other traders and learn a bit about timing your market exposure.

Statistical viability

More power to statistics. Evaluate early if you were just lucky or if your system is the real deal.